What is the Difference Between Inelasticity and Elasticity of Demand?

Elasticity of demand and inelasticity of demand are two important concepts in economics. Understanding the difference between them can help us analyze how responsive the quantity demanded of a good is to changes in price.

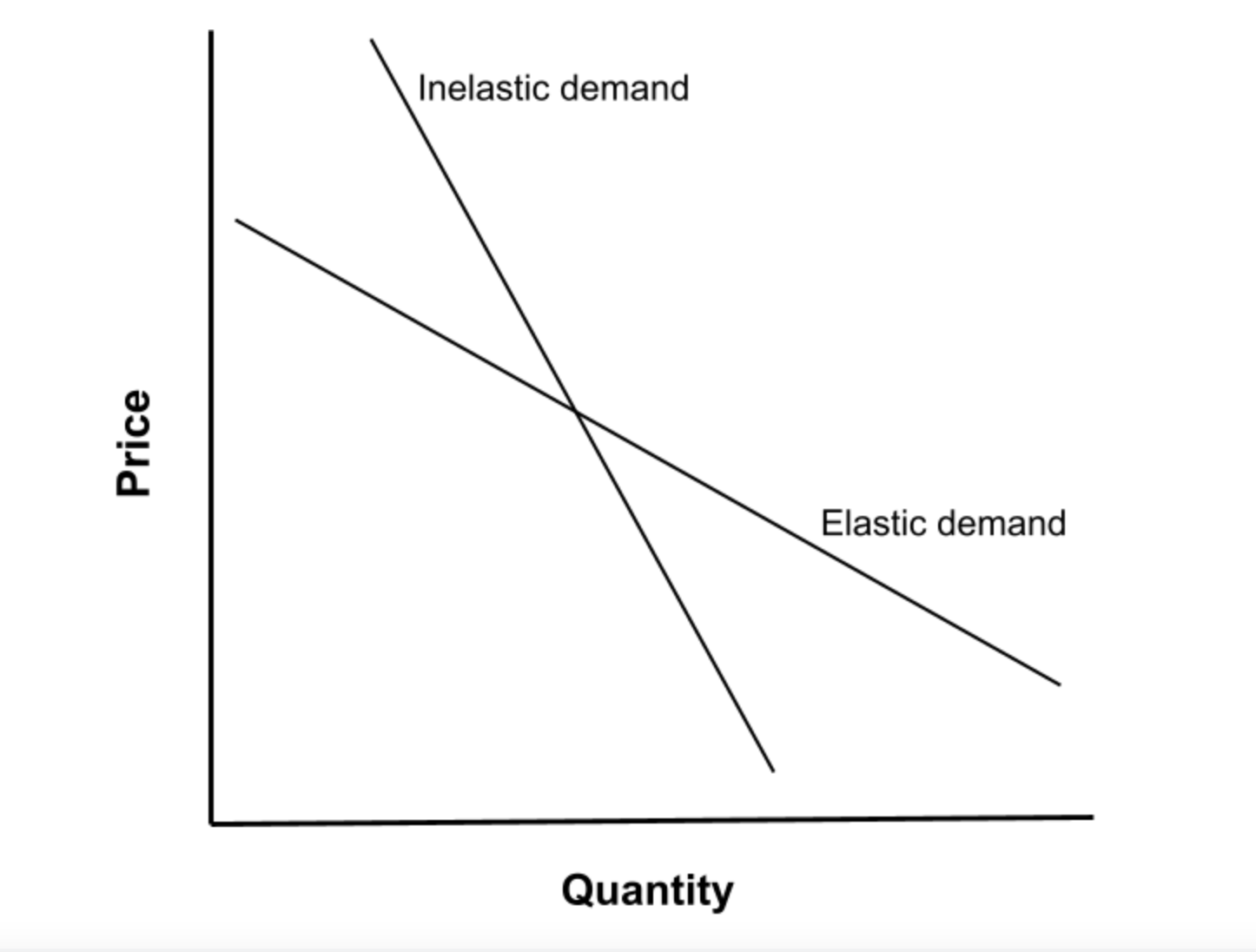

Elasticity of demand refers to the sensitivity of the quantity demanded to changes in price. In contrast, inelasticity of demand indicates that the quantity demanded remains relatively constant when the price changes.

When a good is considered inelastic, it means that the demand for that good is not very responsive to changes in price. Inelastic goods typically have demand elasticity values less than 1. This means that a percentage change in price will result in a smaller percentage change in quantity demanded.

Factors such as the availability of substitutes, the necessity of the good, the proportion of income spent on the good, and the time period under consideration influence the demand elasticity of a good (Investopedia).

Various factors can influence a change in demand elasticity. Changes in consumer preferences, technological advancements, income levels, and pricing strategies are some examples. These factors can impact the responsiveness of consumers to changes in price (Iowa State University).

Utility is another important concept in economics. It refers to the satisfaction or pleasure individuals derive from consuming goods and services. Utility can be measured and classified into types such as total utility and marginal utility.

Total utility represents the overall satisfaction that a consumer attains from consuming a certain quantity of a good or service. On the other hand, marginal utility refers to the additional satisfaction obtained from consuming one additional unit of a good or service (BYJU’s).

The law of diminishing marginal utility explains that as individuals consume more of a good, the additional satisfaction obtained from each additional unit diminishes. This is because they have already satisfied their most urgent needs and are obtaining less benefit from each additional unit (Key Differences).

In economics, equilibrium occurs when the quantity demanded of a good or service equals the quantity supplied in a market. It is the point where the supply and demand curves intersect, determining the market price and quantity (Investopedia).

Changes in income levels can also affect the demand for goods and services. This is known as the income effect. An increase in income may lead to an increase in demand for certain goods or services (Indeed).

Indifference curves are used to represent different combinations of goods or services that yield the same level of utility for a consumer. These curves help economists understand consumer preferences and choices based on the concept of utility (MasterClass).

In economics, consumer surplus is a measure of the economic benefit that consumers receive when they are able to purchase a good or service at a price lower than their willingness to pay. It represents the difference between the price consumers are willing to pay and the actual price they pay in the market (EDUCBA).

Comparative advantage refers to the ability of an individual, firm, or country to produce a good or service at a lower opportunity cost than others. It leads to specialization and trade, maximizing overall economic efficiency (Symson).

Economies of scale occur when the average cost of producing a good or service decreases as the quantity produced increases. This can result from factors such as efficient use of resources, better technology, and spreading fixed costs over a larger production volume (Investopedia).

Perfect competition is a market structure characterized by a large number of buyers and sellers, homogeneous products, free entry and exit, and perfect information. In a perfectly competitive market, no individual buyer or seller can influence the market price (Quizlet).

The concept of the invisible hand, introduced by Adam Smith, suggests that individuals pursuing their own self-interests inadvertently benefit society as a whole. The market mechanism guides the allocation of resources without requiring any central planning (University at Albany).

Market failure occurs when the allocation of goods and services in a market is inefficient and does not lead to the optimal outcome. This can be caused by factors such as externalities, monopoly power, asymmetric information, and public goods (Investopedia).

These concepts and topics in economics help us understand the behavior of individuals and markets, and how they interact to determine prices, quantities, and overall economic outcomes.

Leave a Reply