Understanding the Difference Between Venture Capital and Private Equity in the USA

When it comes to financing options for businesses, two terms often heard are venture capital and private equity. While they are both related to investments, they have distinct characteristics. In this article, we will delve into the differences between venture capital and private equity, explore the role of a venture capitalist, discuss the need for venture capital money in startups, and discover how to become a venture capital associate. Additionally, we will provide guidance on raising seed capital for startups. Let’s get started!

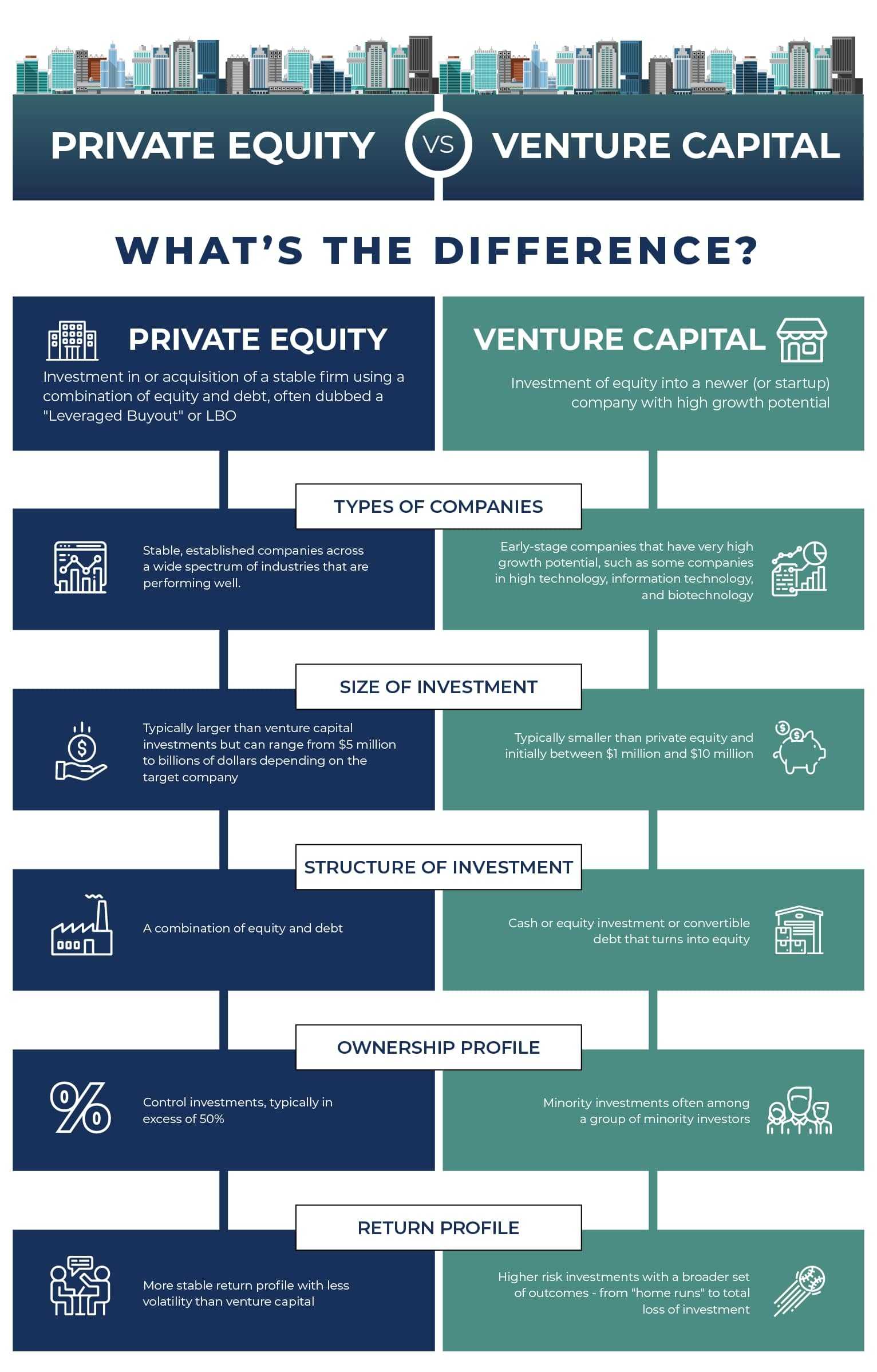

Understanding Venture Capital and Private Equity

Venture Capital:

Venture capital (VC) refers to the investment provided to startups and early-stage companies. VC firms invest in high-potential companies with a promising business model and growth potential. In return for their investment, venture capitalists typically receive an ownership stake in the company. They play an active role in managing and guiding the company towards success.

Private Equity:

Private equity, on the other hand, involves investing in established companies that require significant capital for expansion, restructuring, or acquisitions. Private equity firms raise funds from various sources such as pension funds, endowments, and high net worth individuals. They acquire a controlling stake in the target company and aim to increase its value over a certain period before exiting the investment.

Becoming a Venture Capitalist

What Does a Venture Capitalist Do?

Venture capitalists are investors who provide capital to startups and entrepreneurial ventures. They play a crucial role in nurturing the growth and success of these companies. Their responsibilities include conducting due diligence, negotiating deals, and providing strategic guidance. Venture capitalists often have industry-specific expertise and connections that can benefit the companies they invest in.

How to Become a Venture Capital Associate

Becoming a venture capital associate is a common entry point into the world of venture capital. Here are some steps to consider:

- Gain relevant education: Pursue a degree in finance, economics, business administration, or a related field. Consider specializing in entrepreneurship or venture capital.

- Acquire industry experience: Gain experience by working in investment banking, consulting, or a related field. Develop a strong understanding of financial analysis, valuation, and market trends.

- Network extensively: Attend industry events, join professional organizations, and reach out to venture capitalists for informational interviews. Building a solid network is crucial in venture capital. (Reference: kv-legal.com)

- Develop investment acumen: Stay updated on the latest industry trends and investment opportunities. Learn to evaluate business plans, financial projections, and market dynamics.

- Prove your value: Consider taking on internships or associate roles within venture capital firms to demonstrate your skills and dedication. Show that you are comfortable with the demands of the job.

Evaluating the Need for Venture Capital Money in Startups

Obtaining venture capital money can be a significant milestone for startups. However, it is crucial for founders to carefully assess whether seeking venture capital funding is the right path for their business. Consider the following factors:

- Scale and growth potential: Assess if your business has significant growth potential and the ability to scale rapidly. Venture capitalists are typically interested in businesses that can generate substantial returns on investment.

- Market dynamics: Evaluate the market size, competition, and growth trends to determine whether venture capital is necessary to gain a competitive edge.

- Timing: Determine the stage of your business and whether it is the right time to seek external funding. Some startups may need to demonstrate traction, while others may need capital to fuel early-stage growth.

Raising Seed Capital and Growing Your Startup

Seed Capital

Seed capital refers to the initial funding needed to launch a startup. It is usually sourced from founders, friends and family, angel investors, or venture capitalists. Here are some tips for raising seed capital:

- Craft a compelling pitch: Clearly articulate your business idea, market opportunity, and how you plan to capture value. Tailor your pitch to your specific audience.

- Develop a strong network: Leverage your network to find potential investors. Attend startup events, pitch competitions, and angel investor networks to connect with individuals interested in early-stage investments.

- Show traction and potential: Demonstrate progress and traction in your business, even at the early stages. Investors want to see that you have validated your idea and have the potential to grow. (Reference: uschamber.com)

- Be prepared and adaptable: Anticipate investor questions and concerns. Be prepared to pivot or adjust your business model based on market feedback.

Growing Your Startup

Once you secure seed capital, the focus shifts to growing and scaling your startup. Consider the following strategies:

- Build a strong team: Surround yourself with a talented and passionate team that complements your skills. Identify key hires and allocate resources strategically.

- Execute your business plan: Translate your vision into action. Set clear goals and milestones, and regularly track and measure progress.

- Cultivate relationships: Strengthen your relationships with customers, suppliers, and partners. Build a strong brand presence and engage with your target audience effectively.

- Optimize operations: Continuously analyze and improve your business processes to drive efficiency and maximize growth potential.

Conclusion

Understanding the differences between venture capital and private equity is crucial for entrepreneurs and investors alike. Venture capital plays a vital role in supporting startups and facilitating their growth, while private equity focuses on mature companies requiring significant capital infusion. For those interested in becoming venture capitalists, gaining relevant education, experience, and building a strong network are key steps. Startups should carefully evaluate their need for venture capital funding and consider alternative financing options. Ultimately, securing seed capital and efficiently growing a startup requires a strategic approach, strong execution, and ongoing adaptation to market dynamics.

Other references:

- investopedia.com

- masschallenge.org

- pitchbook.com

- mergersandinquisitions.com

- fe.training

- guides.library.harvard.edu

Leave a Reply