Understanding Interest Rates: A Comprehensive Guide

Interest rates play a crucial role in borrowing and investing decisions. They determine the cost of borrowing money and the earnings from deposit accounts. In this comprehensive guide, we will delve into the intricacies of interest rates, explaining different types, factors affecting them, and their implications.

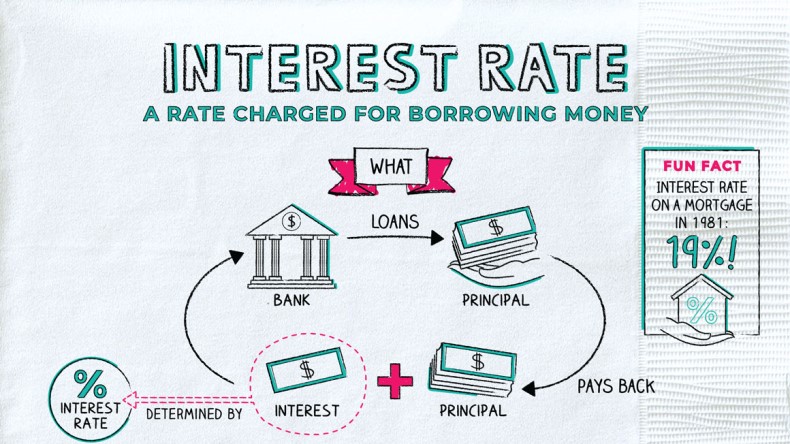

What are Interest Rates?

Interest rates are the charges imposed by lenders on borrowers for the use of their funds. They are expressed as a percentage of the loan amount and are commonly known as the Annual Percentage Rate (APR). The same concept applies to earnings from deposit accounts, referred to as the Annual Percentage Yield (APY). Investopedia provides a detailed explanation of interest rates.

Types of Interest Rates

Different types of interest rates are used in various loan products. Simple interest is popular for loans like mortgages, where interest is calculated only on the principal loan amount. Conversely, compound interest, which includes both the principal and accumulated interest from previous periods, is utilized in certain loans. Understand more about the distinction between simple and compound interest at the Student Aid website.

Factors Affecting Interest Rates

When determining interest rates, lenders consider the risk associated with a borrower. Low-risk borrowers typically qualify for lower interest rates, while high-risk individuals face higher interest rates. The risk assessment is influenced by factors such as credit scores. Find out how credit scores impact interest rates on the Consumer Finance website.

The Role of Central Banks

The state of the economy affects interest rates, which is why central banks like the Federal Reserve have a significant role in setting them. By altering interest rates, central banks aim to stimulate economic growth or slow down consumer demand. Learn more about how interest rates affect the economy at the Treasury Department’s website.

Savings Accounts and Compound Interest

Savings accounts and Certificates of Deposit (CDs) generate earnings through compound interest. With compound interest, the interest earned is added to the account balance, allowing savings to grow faster. Explore interest rates on savings accounts and CDs at the Treasury Direct website.

Conclusion

Interest rates are a fundamental aspect of borrowing and investment decisions. Understanding the types of interest rates, the factors affecting them, and the role of central banks can help individuals and businesses make informed financial choices. Always compare interest rates to ensure the best terms and potential savings. For more information, refer to the resources provided below:

Leave a Reply