Understanding Bitcoin Halving and Its Implications for the Financial Market

Bitcoin halving is an event that occurs approximately every four years when the network mines 210,000 blocks. During this event, the block reward given to Bitcoin miners for processing transactions is cut in half. This reduction in the rate at which new bitcoins are released into circulation has significant implications for the cryptocurrency market.

What is Bitcoin Halving?

Bitcoin halving refers to the process in which the block reward for miners is reduced by half after the mining of every 210,000 blocks. This event, known as halving, signifies the reduction in the rate of new bitcoins entering circulation. The goal is to gradually approach the proposed limit of 21 million coins, which is expected to be reached by around 2140.

Impact of Bitcoin Halvings

Bitcoin halvings have noteworthy implications for the cryptocurrency market. By reducing the rate at which new bitcoins are produced, halvings create a sense of scarcity and potentially increase demand for the cryptocurrency. This dwindling supply of new bitcoins contributes to its value proposition and can drive up its price.

Timeline of Bitcoin Halvings

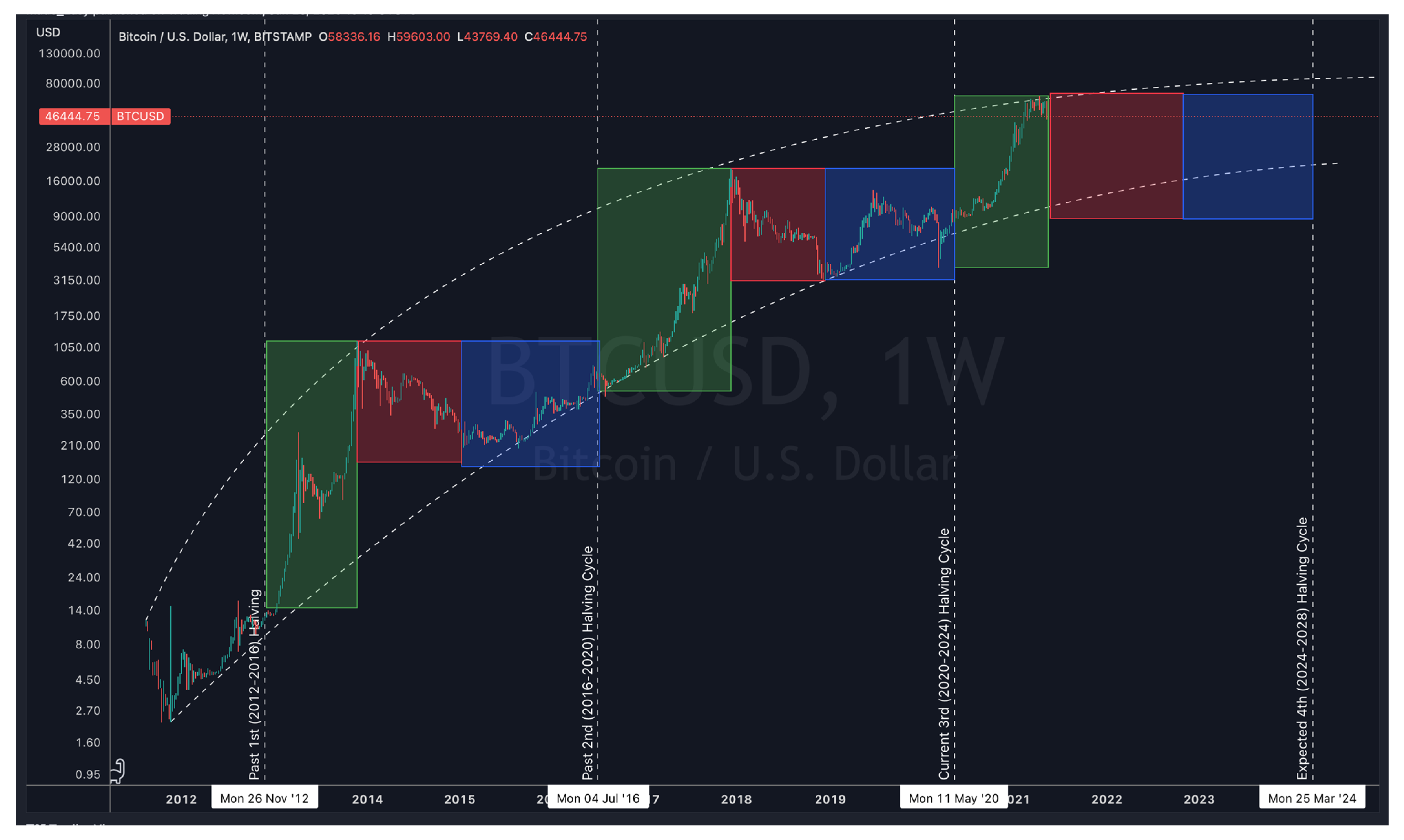

As of April 2023, there have been three halving events:

- November 28, 2012: The block reward was reduced to 25 bitcoins.

- July 9, 2016: The block reward was further reduced to 12.5 bitcoins.

- May 11, 2020: The most recent halving event resulted in a block reward of 6.25 bitcoins.

Frequency of Bitcoin Halvings

Bitcoin halvings occur approximately every four years. The exact timing of halving events can vary due to fluctuations in the mining algorithm. The algorithm is designed to find new blocks approximately every 10 minutes, but slight variations in block mining time can affect the timing of halving events.

Mining Rewards and the Future

Once the 21 million bitcoin limit is reached, miners will no longer receive block rewards. Instead, they will rely on transaction fees paid by network users to incentivize their participation and maintain the blockchain network. This transition from block rewards to transaction fees ensures the continued operation of the network even after all the bitcoins are mined.

Conclusion

Bitcoin halving is a significant event in the cryptocurrency market. It reduces the rate at which new bitcoins are produced, leading to potential price increases and heightened demand. With the last halving expected to occur around 2140, the mining reward will continue to decrease gradually, further emphasizing the scarcity and value of bitcoins. It is essential for investors and market participants to understand the implications of halvings, as they can have a profound impact on the financial landscape.

Other references:

- Bitcoin Halving Research Paper

- Investopedia – Bitcoin Halving

- Forex.com – What is Bitcoin Halving?

- IntechOpen – Bitcoin Halving

- SoFi – Bitcoin Halving Explained

- Fidelity Digital Assets – Understanding Bitcoin Halving

- Analyics Insight – Impact of Bitcoin Halving

- CoinDesk – Bitcoin Halving Explained

- LiveMint – What is Bitcoin Halving?

Leave a Reply